Employee Business Expenses 2024 Tax – While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security . Rushing to get your records and receipts together can cause errors resulting in penalties. Here are a few areas to focus on to make the season less stressful. .

Employee Business Expenses 2024 Tax

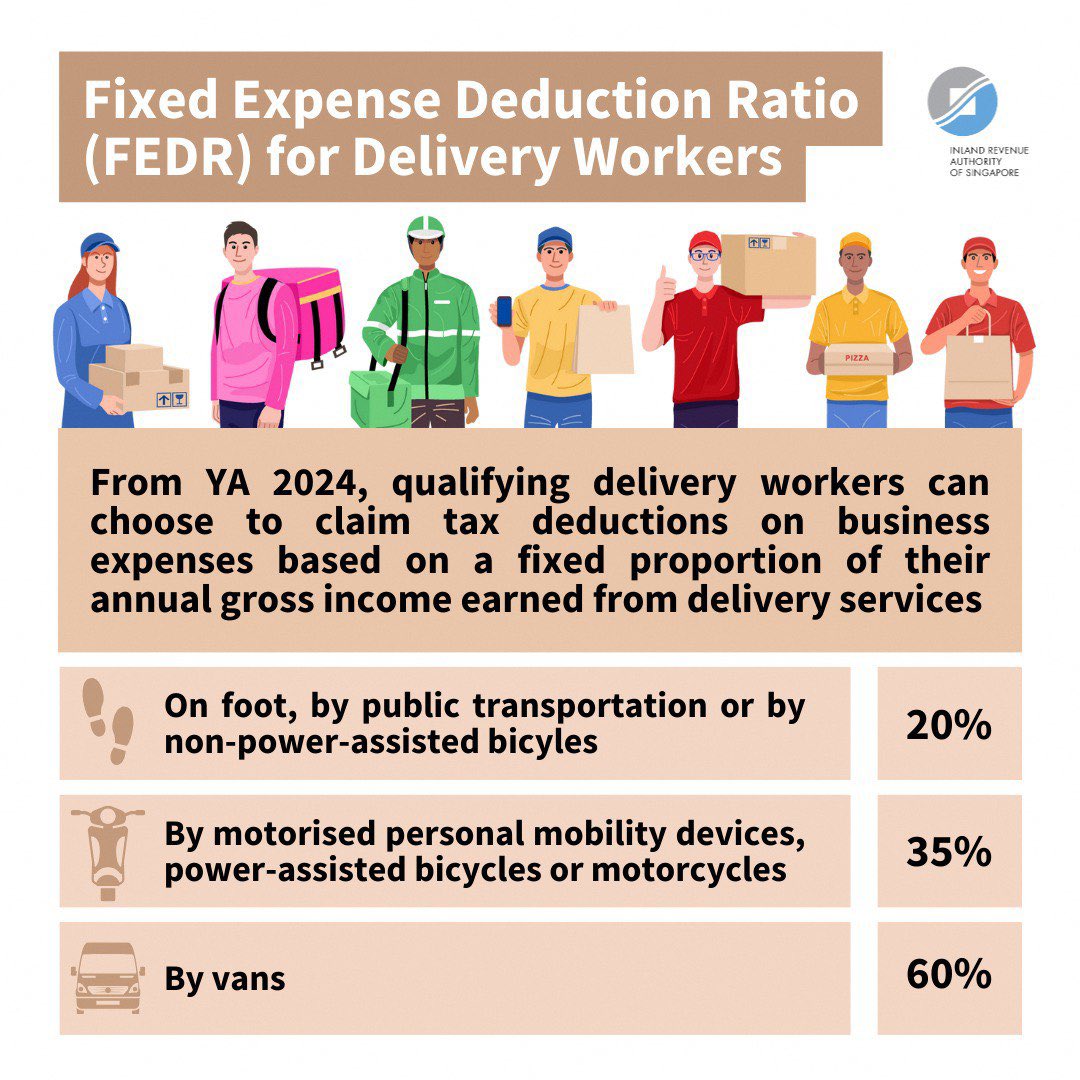

Source : www.freshbooks.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comBusiness Office

Source : www.gmucsd.orgTodd Harrison on X: “🇺🇸 #cannabis 🌿 https://t.co/LEN9R7xeqK” / X

Source : twitter.comSelf Employment Tax Deductions and Benefits 2024 Absetax

Source : absetax.comMcDaniel & Associates, P.C. | Dothan AL

Decoding the Tax Relief for American Families and Workers Act

Source : engineeredtaxservices.comVan Beek & Co., LLC | Tigard OR

Source : m.facebook.comSan Diego Mayor Todd Gloria on X: “The @CityofSanDiego is

Source : twitter.comThe Burns Firm, Ltd. | Dallas TX

Source : m.facebook.comEmployee Business Expenses 2024 Tax 25 Small Business Tax Deductions To Know in 2024: Owning your own business is a goal of many Americans. To be your own boss and to be in charge and run a business in the manner that you desire is something many people aspire to. Businesses are . It is a transfer tax, not an income tax. Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver Pay directly for medical .

]]>